pay indiana state sales taxes

Whether youre a large multinational. Indiana State Sales Tax information registration support.

How Do State And Local Sales Taxes Work Tax Policy Center

Although trade or dealer discounts are taken off from the sales price any manufacturer discounts are not deducted from the sales price for tax purposes.

. To register for Indiana business taxes please complete the Business Tax Application. If you work in or have business income from Indiana youll likely need to file a tax return with us. Delivery Spanish Fork Restaurants.

Restaurants In Matthews Nc That Deliver. Soldier For Life Fort Campbell. Essex Ct Pizza Restaurants.

You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax. Special Fuel SF-900 SF-401 Aviation Fuel AVF-150. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Simply charge the 7000 flat sales tax rate on all items whether selling in.

Groceries and prescription drugs are exempt from the Indiana sales tax. Calculating sales tax on goods sold in Indiana is easy. Sales Tax Collection Discounts In Indiana.

Follow this link httpswwwintaxingov to come to this screen. INtax only remains available to file and pay the following tax obligations until July 8 2022. Ad New State Sales Tax Registration.

How to Sign-in and File a Return on Indianas Website. However some counties within Indiana have an additional tax rate making the combined tax rate ranging from 373 percent to 613 percent. You can check specific county rates listed by the Department of Revenue.

For the feds youll need to register with the IRS. Income Tax Rate Indonesia. Send in a payment by the due date with a check or money order.

You will pay Indiana sales and use tax by. 430 pm EST. Sign in with your username and password.

But for the Department of Revenue you can do it here. When you receive a tax bill you have several options. The state charges a 7 sales tax on the total car price at the moment of registration.

When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. How To Pay Indiana State Sales Tax. INtax remains available for the following tax obligations until July 8 2022.

Have more time to file my taxes and I think I will owe the Department. Indiana is an easy state in which to collect sales tax. Opry Mills Breakfast Restaurants.

INTIME user guides are available if needed. Lets start with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Indiana. All foreign businesses must adhere to Indianas employment tax requirements.

If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales. Indiana businesses have to pay taxes at the state and federal levels.

Out of State Because everyone in the state has the same 700 sales tax rate the method of taxation doesnt matter as. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source.

You should also know the amount due. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Know when I will receive my tax refund. Counties and cities are not allowed to collect local sales taxes. Corporations must pay the Indiana Corporate Income Tax but LLC businesses avoid double taxation.

Take the renters deduction. For Those in State You can file your Indiana States sales tax collected with Form ST-103 or do it online through the. Any employees will also need to pay state income tax.

Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit. Indiana allows merchants to keep a small percentage of the sales tax they collect as a collection discount which serves as compensation for the work required to comply with the. ATTENTION-- ALL businesses in Indiana must file and pay their sales and withholding taxes electronically.

INTAX only remains available to file and pay special tax obligations until July 8 2022. The state income tax. Find Indiana tax forms.

2022 Indiana state sales tax. Pay my tax bill in installments. Claim a gambling loss on my Indiana return.

The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. Indiana has a statewide rate of 7 so despite where you live you just collect 7 for tax in Indiana. County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1.

For more information on the modernization project visit our. Exact tax amount may vary for different items. The Indiana income tax rate is set to 323 percent.

How To Register For A Sales Tax Permit Taxjar

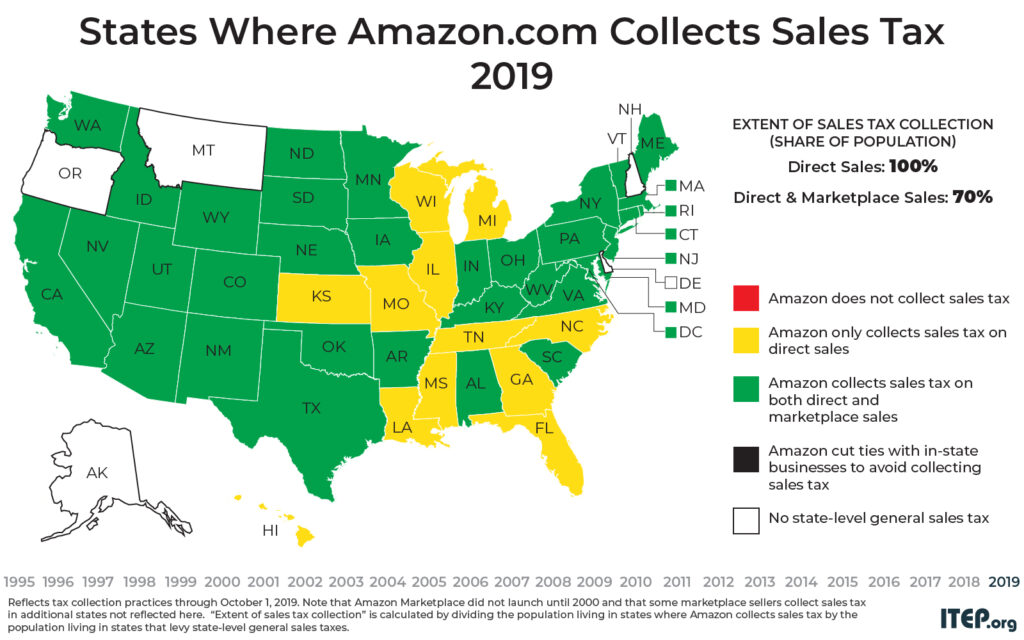

A Visual History Of Sales Tax Collection At Amazon Com Itep

Sales Tax By State Is Saas Taxable Taxjar

Publication 600 2006 State And Local General Sales Taxes Internal Revenue Service

Precious Metals Sales Tax Rules Regulations By State Buy Gold And Silver Coins Bgasc Com

How To Pay Sales Tax For Small Business 6 Step Guide Chart

U S Sales Taxes By State 2020 U S Tax Vatglobal

How Do State And Local Sales Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Updated State And Local Option Sales Tax Tax Foundation

Indiana Sales Tax Handbook 2022

Indiana Sales Tax Small Business Guide Truic

When Did Your State Adopt Its Sales Tax Tax Foundation